Focus turns to January NFP

What to look out for today

Companies reporting on Wednesday, 11th February: Albemarle, Cisco Systems, CVS Health, Equinix, Hilton Worldwide, Humana, Kraft Heinz, Martin Marietta Materials, McDonald’s, MGM Resorts International, Motorola Solutions, Smurfit WestRock, and T-Mobile US

Key data to move markets today

USA: Nonfarm Payrolls, Nonfarm Payrolls Benchmark Revision, Average Hourly Earnings, U6 Unemployment Rate, Unemployment Rate, CPI, and Core CPI, and speeches by Kansas City Fed President Jeff Schmid, Cleveland Fed President Beth Hammack, and Fed Governor Michelle Bowman

EU: Speeches by ECB Board members Piero Cipollone and Isabel Schnabel

US Stock Indices

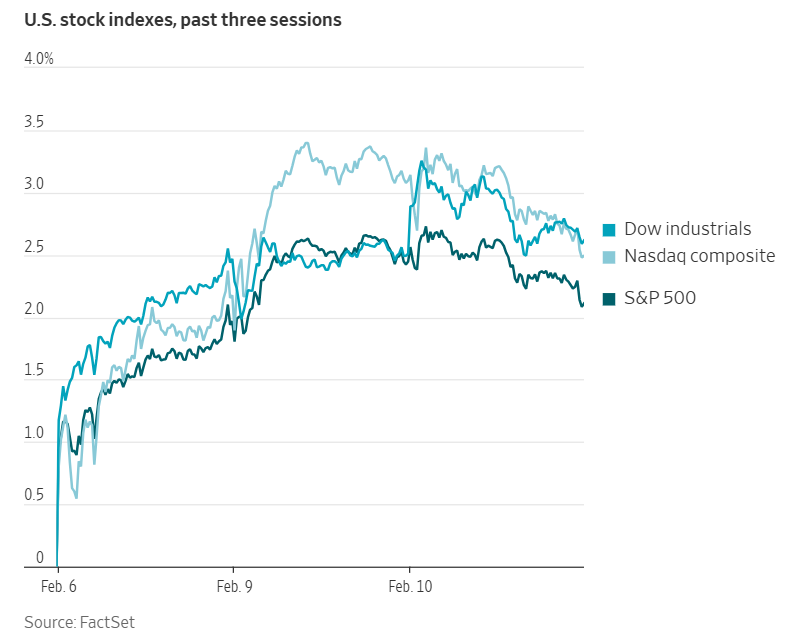

Dow Jones Industrial Average +0.10%

Nasdaq 100 -0.56%

S&P 500 -0.33%, with 6 of the 11 sectors of the S&P 500 down

Concerns regarding AI expanded beyond the technology sector on Tuesday, exerting downward pressure on wealth management firms within the financial services industry.

During morning trading, financial-technology firm Altruist announced the introduction of an AI tool designed to generate personalised tax strategies by analysing financial documents, eliminating the need for manual data entry.

Investor sentiment had already been shaken by the recent decline in software and technology stocks, a trend that intensified following the rollout of AI-driven tools capable of automating complex, industry-specific tasks. Although technology shares have stabilised recently, apprehension surrounding AI has now extended to financial services—a sector that previously benefitted from rotation out of software and AI equities.

Major equity benchmarks delivered mixed results for the day. The S&P 500 declined by -0.33%, weighed down by a -0.75% decrease in the Financials sector. The Nasdaq Composite fell -0.59%, whereas the Dow Jones Industrial Average ticked up +0.10% to close at 50,188.14, marking its third consecutive record high.

In corporate news, Blackstone is expanding its investment in artificial intelligence company Anthropic PBC, raising its stake to approximately $1 billion based on the startup’s current valuation, according to sources familiar with the matter.

Meta Platforms has invested in thousands of television advertisements to highlight its efforts toward teen safety, ahead of a significant jury trial that will examine whether the company intentionally designs products to foster social media addiction among minors.

Walt Disney completed a $4 billion bond issuance—its first since 2020—joining a wave of corporate activity as firms move to secure more favourable borrowing costs.

Electronic Arts’ bonds experienced a sharp decline after potential acquirers of the video game company initiated a buyback offer that linked the bonds’ prices to US Treasury yields.

S&P 500 Best performing sector

Utilities +1.59%, with Vistra +4.33%, Edison International +2.62%, and Sempra +2.54%

S&P 500 Worst performing sector

Communication Services -0.84%, with Alphabet -1.78%, Meta Platforms -0.96%, and Match Group -0.31%

Mega Caps

Alphabet -1.78%, Amazon -0.84%, Apple -0.34%, Meta Platforms -0.96%, Microsoft -0.11%, Nvidia -0.79%, and Tesla +1.89%

Information Technology

Best performer: Dell Technologies +4.22%

Worst performer: Western Digital -8.19%

Materials and Mining

Best performer: Celanese +5.98%

Worst performer: Steel Dynamics -0.80%

Corporate Earnings Reports

Posted on Tuesday, 10th February

Ford Motor quarterly revenue -4.8% to $45.900 bn vs $44.168 bn estimate

EPS at $0.13 vs $0.13 estimate

Jim Farley, President and CEO, said, “Ford delivered a strong 2025 in a dynamic and often volatile environment. We improved our core business and execution, made significant progress in the areas of the business we control – lowering material and warranty costs and making real progress on quality – and made difficult but critical strategic decisions that set us up for a stronger future. Moving forward, we’ll continue building on our strong foundation to achieve our target of 8% adjusted EBIT margin by 2029.” — see report.

The Coca-Cola Co quarterly revenue +3.5% to $11.800 bn vs $12.049 bn estimate

EPS at $0.58 vs $0.56 estimate

James Quincey, Chairman and CEO, said, “I’m encouraged by our performance in 2025 which showed both the resilience and momentum that define our business. Looking ahead, we will focus on executing our strategy even better and positioning our system for long-term success.” — see report.

Marriott International quarterly revenue +4.1% to $6.690 bn vs $6.670 bn estimate

EPS at $2.58 vs $2.60 estimate

Anthony Capuano, President and CEO, said, “In the fourth quarter, worldwide RevPAR rose 1.9 percent, driven by ADR gains. International RevPAR increased 6 percent, led by EMEA and APEC, benefiting from solid leisure transient and cross-border travel. In the U.S. & Canada, RevPAR was roughly flat, reflecting the impact of the extended government shutdown primarily on the business transient segment. Globally, our luxury hotels continued to outperform during the quarter, with RevPAR rising over 6 percent, and performance moderating down the chain scales. Our global RevPAR index, which remains at a significant premium to peers, rose in the fourth quarter and for the full year.” — see report.

European Stock Indices

CAC 40 +0.60%

DAX +1.19%

FTSE 100 +0.16%

Commodities

Gold spot -0.68% to $5,023.35 an ounce

Silver spot -3.10% to $80.78 an ounce

West Texas Intermediate -0.34% to $64.20 a barrel

Brent crude -0.17% to $69.01 a barrel

Gold experienced a modest decline of less than one percent on Tuesday, as the market underwent a period of consolidation.

Spot gold decreased by -0.68%, settling at $5,023.35 per ounce.

In January, Indian investors showed a marked preference for gold exchange-traded funds, with inflows surpassing those into equity funds for the first time, according to industry data released on Tuesday, reflecting the impact of rising gold prices.

Spot silver also saw a decline, slipping by -3.10% to $80.78 per ounce.

The London Bullion Market Association reported that silver held in London vaults totalled 27,729 metric tons at the end of January, representing a decrease of 0.3% compared to December. Meanwhile, gold stocks in London increased by 0.6% to 9,158 tons.

Oil prices remained largely stable on Tuesday, as market participants awaited further direction regarding diplomatic developments between the US and Iran.

Brent crude futures edged down by 12 cents, or -0.17%, closing at $69.01 per barrel, while US WTI crude declined by 22 cents, or -0.34%, to settle at $64.20 per barrel.

On Tuesday, a spokesperson for Iran's foreign ministry stated that recent nuclear discussions with the United States had enabled Tehran to assess Washington's intentions, and that there was sufficient consensus to continue diplomatic efforts.

In an interview on Tuesday, the US President expressed his belief that Iran is inclined to reach an agreement regarding its nuclear and ballistic missile programmes, and remarked that it would be ‘foolish’ for Tehran not to pursue such a deal.

The Wall Street Journal reported on Tuesday that US officials have considered the seizure of tankers transporting Iranian oil in an effort to exert pressure on Tehran. However, there are concerns about possible retaliation and the potential repercussions for global oil markets.

Last week, US and Iranian diplomats engaged in discussions through intermediaries in Oman in an attempt to revive diplomatic channels, following the deployment of a US naval flotilla in the region, which had heightened concerns about potential military escalation.

In Venezuela, the US Energy Information Administration indicated on Tuesday that expanded American licences are anticipated to restore the OPEC member's oil production to levels observed prior to the US naval blockade imposed in December, with recovery expected by mid-2026.

Note: As of 4 pm EST 10 February 2026

Currencies

EUR -0.17% to $1.1894

GBP -0.39% to $1.3640

Bitcoin -2.47% to $68,625.71

Ethereum -5.37% to $2,007.68

On Tuesday, the US dollar experienced a modest decline against the yen, while strengthening against both the euro and the British pound, following economic data that revealed a deceleration in US growth. The yen, meanwhile, advanced and was poised for a second consecutive session of gains, buoyed by Prime Minister Sanae Takaichi’s recent election victory.

The dollar index edged down by -0.01% to 96.86, after touching a one-week low of 96.609 during the session. The euro declined by -0.17% to $1.1894, after having surged by +0.85% on Monday. The British pound declined -0.39% to $1.3640.

The Japanese currency appeared set to extend its upward momentum, having broken a six-day losing streak on Monday in the wake of Takaichi's electoral success. The currency approached the 160 mark against the US dollar, raising concerns that Japanese authorities might intervene to bolster the yen.

Prime Minister Takaichi's proposed policies, which encompass tax reductions and increased fiscal expenditure, are anticipated to stimulate economic growth and boost the stock market. These measures may encourage the Bank of Japan to adopt a more hawkish stance, factors that are likely to lend further support to the yen.

The yen appreciated by +0.95% to ¥154.38 per US dollar, following a 0.85% gain recorded the previous day.

Fixed Income

US 10-year Treasury -6.4 basis points to 4.148%

German 10-year -2.9 basis points to 2.814%

UK 10-year gilt -1.6 basis points to 4.519%

On Tuesday, US Treasury yields declined across the curve following a series of economic releases indicating a potential softening in the economy, which could provide the Fed with greater flexibility to reduce interest rates.

The Commerce Department reported that retail sales remained unchanged in December, falling short of economists’ expectations for a 0.4% increase and below the unrevised 0.6% rise recorded in November.

Separately, the Labour Department’s data revealed that the Employment Cost Index (ECI), the most comprehensive measure of labour costs, rose by 0.7% in the fourth quarter. This marks a moderation from the 0.8% increase seen in the previous quarter and came in below the anticipated 0.8% rise, as labour demand continued to ease.

The yield on the US 10-year Treasury note fell by -6.4 bps to 4.148%, registering its fourth consecutive day of declines. Over this period, the yield has dropped more than 13 bps, representing the most significant four-day fall since mid-October.

The 30-year bond yield declined by -5.9 bps to 4.803%, the largest single-day decrease since 10th October.

The yield on the two-year US Treasury, which often reflects market expectations for Fed funds rates policy, slipped by -3.6 bps to 3.464%.

An auction of $58 billion in three-year notes was generally seen as robust by analysts, with a bid-to-cover ratio of 2.62x, marginally below the recent average of 2.68x.

Further supply is expected this week, with the Treasury set to auction $42 billion in 10-year notes today and $25 billion in 30-year bonds tomorrow.

The US Treasury yield curve, as measured by the spread between two- and 10-year notes, currently stands at 68.4 bps.

According to CME Group's FedWatch Tool, Fed funds futures traders are pricing in 60.7 bps of cuts in 2026, higher than the 49.7 bps priced in the previous week. Fed funds futures traders are now pricing in a 21.1% probability of a 25 bps rate cut at the 18th March FOMC meeting, up from 9.4% a week ago.

On Tuesday, Germany's 10-year government bond yield fell to its lowest point in over three weeks, reflecting a broader decline across European sovereign yields.

The yield on the German 10-year Bund reached 2.814%, marking its lowest level since mid-January and a decrease of -2.9 bps. Germany's two-year yield edged down by -0.8 bps to 2.068%, and the 30-year yield declined by -4.0 bps to 3.491%.

Italy's 10-year bond yield also retreated, dropping -4.6 bps to 3.410%, which corresponds to a three-week low. This movement left the spread over German Bunds at 59.6 bps.

Similarly, French 10-year yields declined by -4.1 bps to 3.400%.

Note: As of 5 pm EST 10 February 2026

Global Macro Updates

Preview: January NFP. The Bureau of Labor Statistics is scheduled to release the January nonfarm payrolls report today at 8:30 am ET. This release was postponed from its original date of 6th February due to the brief US government shutdown. The report follows a below-consensus reading of 22,000 for ADP private payrolls in January, as well as a notable decline in job openings indicated by December’s JOLTS report.

Market expectations centre on payroll growth of approximately 70,000, representing a modest improvement from the 50,000 increase observed in December. The unemployment rate is anticipated to remain steady at 4.4%. However, analysts suggest risks are tilted to the upside given the subdued hiring environment, whereas others view risks as skewed slightly lower, citing December’s unrounded rate of 4.375%. Average hourly earnings are forecast to rise by 0.3% m/o/m, mirroring the pace seen in December.

There are, however, several potential tailwinds for employment. A weaker seasonal hiring trend in Q4 likely led to fewer layoffs at the start of the new year. Additionally, warmer weather early in January is thought to have supported job creation, and residual seasonality may continue to provide a boost. Conversely, some previews suggest that delayed retirements among federal workers could weigh on the numbers.

Several analysts also highlighted the Bureau of Labor Statistics' announced adjustments to the Birth-Death model, which estimates employment changes resulting from business formations and closures. There is some concern that these changes could introduce downside risk to private employment figures.

Although not directly impacting January employment, the upcoming report will include the annual benchmarking of 12 months of jobs data through March 2025 to the QCEW dataset. The preliminary estimate released by the BLS in September forecast a downward revision of 911,000 jobs for this period; most previews anticipate the final adjustment will be somewhat less pronounced.

In general, analyst previews do not foresee a dramatic deterioration in the labour market that would significantly influence Fed policy. Nonetheless, the recent decline in JOLTS job openings, coupled with Challenger-reported layoffs reaching a multiyear high, has led to a modest increase in expectations for monetary easing in 2026, with futures now pricing in a full 50 bps of rate cuts.

While every effort has been made to verify the accuracy of this information, EXT Ltd. (hereafter known as “EXANTE”) cannot accept any responsibility or liability for reliance by any person on this publication or any of the information, opinions, or conclusions contained in this publication. The findings and views expressed in this publication do not necessarily reflect the views of EXANTE. Any action taken upon the information contained in this publication is strictly at your own risk. EXANTE will not be liable for any loss or damage in connection with this publication.

本文提供给您仅供信息参考之用,不应被视为认购或销售此处提及任何投资或相关服务的优惠招揽或游说。金融工具交易存在重大亏损风险,未必适合所有投资者。过往表现并非未来业绩的可靠指标。