% to 6,693.75, its 28th record this year

% to $3,746.21 after reaching a record high of $3,747.08

% to $1.1798

Key data to move markets today

EU: French, German, and Eurozone HCOB Composite, Services and Manufacturing PMIs and a speech by ECB Executive Board member Piero Cipollone

UK: S&P Global Composite, Services and Manufacturing PMIs and a speech by BoE Chief Economist Huw Pill

USA: S&P Global Composite, Services and Manufacturing PMIs and Existing Home Sales Change and speeches by Fed Vice Chair for Supervision Michelle Bowman, Atlanta Fed President Raphael Bostic, and Fed Chair Jerome Powell

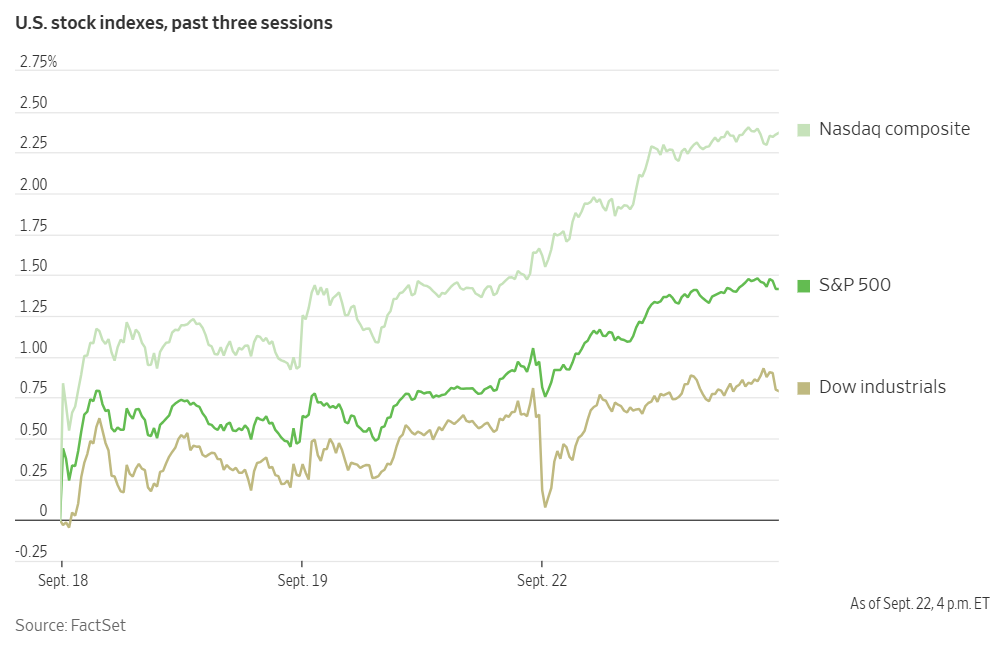

US Stock Indices

Dow Jones Industrial Average +0.14%

Nasdaq 100 +0.55%

S&P 500 +0.44%, with 4 of the 11 sectors of the S&P 500 up

Technology stocks were at the forefront of Monday's market gains, propelling the S&P 500 to its 28th record close of the year. The Nasdaq Composite led the advance with a +0.70% gain. The S&P 500 was +0.44%, while the Dow Jones Industrial Average edged +0.14% higher, adding 66 points.

The strong performance of mega-cap technology stocks has been a defining feature of the market. While some analysts have expressed reservations about the current market setup and the tactical risk/reward of this positioning, there is also a consensus against betting against the momentum of these firms.

In corporate news, as confirmed by a White House official, Oracle is set to play a key role in a proposed deal to sell the popular app TikTok to a consortium of American investors. Under the agreement, Oracle would provide security and oversee the creation of a new US version of TikTok's algorithm.

In an internal leadership change, Oracle also announced the promotion of Clay Magouyrk and Mike Sicilia to the joint role of CEO. Safra Catz, who has led the company since 2014, will transition to the executive vice chair of the board.

Pfizer has agreed to a $4.9 billion acquisition of the obesity startup Metsera. This strategic move is an effort to catch up to rival drugmakers after its own weight-loss medications failed to compete effectively in the market.

CVS Health’s subsidiary Omnicare has filed for bankruptcy protection. The filing follows a court order for the pharmacy-services provider to pay $949 million over claims it improperly dispensed prescription drugs to individuals in long-term care facilities.

Compass has agreed to acquire Anywhere Real Estate in a deal that would create a combined company with an estimated $10 billion enterprise value, solidifying Compass’s position as the largest residential brokerage in the US.

BBVA has increased the value of its takeover bid for Banco Sabadell by approximately 10% in a final attempt to complete a deal that has been delayed for over a year by regulatory reviews and government opposition.

S&P 500 Best performing sector

Information Technology +1.74%, with Teradyne +12.79%, Oracle +6.31%, and Applied Materials +5.48%

S&P 500 Worst performing sector

Communication Services -0.92%, with Match Group -5.40%, Meta Platforms -1.70%, and Paramount Skydance -1.64%

Mega Caps

Alphabet -0.92%, Amazon -1.66%, Apple +4.31%, Meta Platforms -1.70%, Microsoft -0.67%, Nvidia +3.97%, and Tesla +1.91%

Nvidia to invest up to $100 billion in OpenAI. Nvidia has announced a strategic partnership with OpenAI, which includes plans for an investment of up to $100 billion in the ChatGPT maker in exchange for a significant equity stake. The joint effort is aimed at constructing data centres for AI on a massive scale.

As part of the agreement, OpenAI intends to purchase millions of Nvidia’s AI processors to deploy up to 10 gigawatts (GW) of capacity. According to statements from both companies, this capacity is comparable to the output of 10 nuclear reactors. Should Nvidia commit the full $100 billion, it would represent the largest-ever investment in a private company. The deal is also a critical move that ensures Nvidia's technology remains central to OpenAI’s products for years to come.

The partnership holds the potential to generate hundreds of billions of dollars in revenue for Nvidia, whose shares rose +3.97% on Monday. However, a precise timeframe for the deployment has not been specified, and many of the deal's details remain uncertain.

The investment is structured to be made progressively in cash as OpenAI's systems are deployed. The initial $10 billion investment will be committed upon the deployment of the first gigawatt. At OpenAI’s current $500 billion valuation, this would grant Nvidia a 2.0% stake, with subsequent investments to be made at the prevailing valuation. While OpenAI is expected to spend more than $100 billion on Nvidia chips over the course of the build-out, its purchases could be partially funded by Nvidia's investment, with future revenue growth and other funding covering the remainder.

The planned infrastructure, which relates to previously unannounced projects, would require 4 million to 5 million of Nvidia's AI chips, with most of the deployment anticipated to occur in the US. Nvidia estimates the total cost of this 10 GW of AI infrastructure could be as high as $400 billion, encompassing the chips, land, and physical infrastructure.

The first phase of this deal, scheduled to come online in H2 2026, will utilise Nvidia’s next-generation Vera Rubin chip system, the successor to its current Blackwell technology. The scale of Nvidia's potential $100 billion investment is underscored by the fact that it is roughly equivalent to analysts' projections of the company's free cash flow for the current financial year.

Information Technology

Best performer: Teradyne +12.79%

Worst performer: Arista Networks -2.81%

Materials and Mining

Best performer: Newmont +2.45%

Worst performer: International Flavors & Fragrances -2.09%

European Stock Indices

CAC 40 -0.30%

DAX -0.48%

FTSE 100 +0.11%

Commodities

Gold spot +1.70% to $3,746.21 an ounce

Silver spot +2.19% to $44.03 an ounce

West Texas Intermediate -0.78% to $62.23 a barrel

Brent crude -0.06% to $66.60 a barrel

Gold advanced to an all-time high on Monday due to growing expectations of future US interest rate cuts and sustained safe-haven demand amid political uncertainty.

Spot gold climbed +1.70% to $3,746.21 per ounce, after establishing a new record high of $3,747.08 earlier in the session. Demand was reinforced by geopolitical tensions, highlighted by a report from Russia's defence ministry claiming its forces had taken control of the settlement of Kalynivske in Ukraine's Dnipropetrovsk region.

Looking ahead, investors are closely anticipating a series of speeches by Fed officials this week, including remarks from Chair Jerome Powell on Tuesday. Friday's data on the US core personal consumption expenditure (PCE) price index is also a focal point.

Additionally, the BoE’s demand for gold recovered to 63 tonnes, aligning with the post-2022 average and contributing to gold's bullish sentiment.

Oil prices declined on Monday, as concerns about an oversupply of crude oil overshadowed ongoing geopolitical tensions in Russia and the Middle East.

Brent crude oil futures settled down four cents or -0.06% to $66.60 a barrel. Brent has traded within a narrow range of $65.50 to $69 since early August.

The US WTI contract for October, which expires on Monday, fell by 49 cents, or -0.78%, to close at $62.23 a barrel. The more actively traded second-month contract saw a more modest decline of 12 cents, or -0.20%, to end the day at $62.28.

Traders are now focussing on the potential for a global oversupply in the oil market. This outlook is expected to persist unless the US and EU implement more stringent tariffs on countries that purchase Russian crude.

Iraq, the second-largest producer in OPEC, has increased its oil exports under the current OPEC+ agreement and projects its September exports will be between 3.4 million and 3.45 million barrels per day (bpd). Additionally, Kuwait's Oil Minister, Tariq Al-Roumi, stated that the country's crude oil production capacity has reached 3.2 million bpd, its highest level in over a decade.

Deal paves the way for restart of Iraqi crude exports via Turkey. According to Reuters, on Monday, Iraqi federal and Kurdish regional government officials announced a deal with oil firms to restart crude exports through Turkey. This agreement, pending approval by the Iraqi cabinet, would allow for the resumption of roughly 230,000 barrels per day (bpd) in exports from Iraqi Kurdistan. These have been suspended since March 2023.

The preliminary plan would have the Kurdistan Regional Government (KRG) commit to delivering a minimum of 230,000 bpd to the Iraqi state oil marketer, SOMO, while reserving an additional 50,000 bpd for domestic consumption. An independent trader would manage sales from Turkey's Ceyhan port using SOMO's official pricing.

Revenue from these sales would be handled through an escrow account. For each barrel sold, $16 would be allocated to this account and distributed proportionally to producers, with the remaining revenue going to SOMO.

A key point of contention remains the resolution of outstanding payments. The draft agreement does not specify how or when producers will receive approximately $1 billion in unpaid arrears accumulated between September 2022 and March 2023. Additionally, a source close to the negotiations stated that DNO, the largest international producer in Kurdistan, is still seeking to negotiate the repayment of nearly $300 million it is owed by the KRG for past crude deliveries. Neither DNO nor its partner, Genel Energy, has agreed to the proposed terms.

The pipeline was shut down in March 2023 after the International Chamber of Commerce (ICC) ordered Turkey to pay Iraq $1.5 billion in damages for allowing unauthorised exports by the KRG. Although Turkey is appealing the ruling, it has indicated its readiness to restart the pipeline.

The current negotiations have been influenced by pressure from the US, which has urged all parties to reach a resolution. This new development comes as OPEC+ oil-producing nations are adding more barrels to the market in a bid to increase their market share.

Note: As of 5 pm EDT 22 September 2025

Currencies

EUR +0.46% to $1.1798

GBP +0.31% to $1.3508

Bitcoin -2.17% to $113,047.08

Ethereum -6.10% to $4,201.16

The US dollar experienced a broad-based depreciation on Monday due to a series of statements from Fed officials regarding the FOMC monetary policy stance.

The dollar’s value remained near the levels seen before last week's Fed’s announcement, with the dollar index ultimately falling by -0.35% to 97.30.

The dollar was down for the first time in four sessions against the euro; the euro was +0.46% to $1.1798. The dollar was -0.38% against the Swiss franc to 0.7920, ending a three-session streak of gains.

Sterling rose against the dollar on Monday, gaining +0.31% to $1.3508 following Friday's selloff that was driven by UK fiscal concerns.

The dollar fell for a second consecutive session against the Japanese yen, -0.14% to ¥147.74. This may be attributed to political uncertainty surrounding the Liberal Democratic Party leadership election scheduled for 4th October.

Fixed Income

US 10-year Treasury +2.2 basis points to 4.153%

German 10-year bund +0.1 basis points to 2.752%

UK 10-year gilt unchanged at 4.717%

US Treasury yields edged higher on Monday as markets remained cautious regarding the Fed's monetary policy path.

Yields rose last week, even after the FOMC implemented a 25 bps rate cut and signalled further in upcoming meetings. The 10-year Treasury note yield reached its highest point since 5th September, +2.2 bps to 4.153%. The two-year yield, often seen as a reflection of interest rate expectations, hit a three-week high, +3.8 bps from Friday to 3.622%. The 30-year bond yield increased for the fourth consecutive trading session, +2.1 bps to 4.767%.

The spread between the two- and 10-year Treasury yields narrowed to 53.1 bps, a decrease of 1.6 bps from Friday. The spread between the two- and 30-year Treasury yields fell 1.7 bps to 114.5 bps.

Looking ahead, the Treasury Department is scheduled to auction a total of $183 billion in notes this week, including $69 billion in two-year notes, $70 billion in five-year notes, and $44 billion in seven-year notes.

Fed funds futures traders are pricing in a 89.8% probability of a 25 bps rate cut at October’s FOMC meeting, up from 74.3% last week, according to CME Group's FedWatch Tool. Traders are currently anticipating 68.5 bps of cuts by year-end, lower than the 68.8 bps expected last week.

Across the Atlantic, long-tenor eurozone government bond yields rose slightly on Monday due to a week of significant government bond sales across the region.

Germany’s 10-year bond yield ticked up +0.1 bps to 2.752%, while the 30-year yield was +1.7 bps to 3.355%. At the shorter end of the curve, the two-year German yield was -1.2 bps to 2.022%.

Other regional bond yields, including those for France and Italy, generally moved in line with their German counterpart. Italy's 10-year yield was +0.4 bps to 3.546%, leaving the spread over German Bunds at 79.4 bps. The 10-year French yield finished +0.1 bps higher, with its spread over Germany standing at 81.3 bps.

Italy’s 30-year borrowing cost was +2.4 bps to a peak of 4.528%, its highest level since 5th September. The 30-year French yield was +2.7 bps to 4.426%.

These movements follow last week’s broad climb in eurozone bond yields, which was driven by Germany’s announcement of increased debt issuance and policy decisions from the Fed and BoE.

This week, the market anticipates approximately €30 billion worth of bond sales, including new 30-year debt from the Netherlands and 10-year paper from Italy.

Additionally, Euronext, the pan-European stock market operator, announced the launch of a new series of futures products for Europe's main government bonds, including France's 10-year OAT, the German Bund, and Italian government bonds. Euronext stated that these new products are designed to help investors navigate the current period of high volatility in European bond markets. The company added that these offerings will also be a key component of its overall growth strategy.

Note: As of 5 pm EDT 22 September 2025

Global Macro Updates

Fed Governor Miran stands out in recent Fedspeak. A series of comments from Fed officials provided a range of perspectives on the Fed's monetary policy path, highlighting a notable divergence in views.

In a speech at the Economic Club of New York, Fed Governor Miran expressed a significantly dovish stance, stating his belief that the current policy is highly restrictive. He suggested that an appropriate fed funds rate would be in the mid-2% range, roughly 2 percentage points lower than current levels. He further argued that the neutral rate has declined due to factors such as reduced immigration and fiscal tightening.

Conversely, several other officials expressed a more conservative outlook. St Louis Fed President Musalem described his support for last week's 25 bps rate cut as a precautionary measure, but noted he sees limited scope for further easing. He said he would not support additional cuts if inflation risks were to increase. Similarly, Atlanta Fed President Raphael Bostic stated he only pencilled in a single rate cut for 2025, citing ongoing inflation concerns and a resilient labour market. Cleveland Fed President Beth Hammack warned of inflation risk should the Fed cut interest rates too quickly, noting that her estimate for the neutral rate is among the higher end of the spectrum. Richmond Fed President Thomas Barkin, acknowledged signs of a robust labour market while simultaneously noting that inflation remains high.

Some economists have suggested that a deeper rate-cutting cycle in 2026 could be a possibility, particularly if the White House is able to further reshape the composition of the Fed’s Board of Governors.

While every effort has been made to verify the accuracy of this information, EXT Ltd. (hereafter known as “EXANTE”) cannot accept any responsibility or liability for reliance by any person on this publication or any of the information, opinions, or conclusions contained in this publication. The findings and views expressed in this publication do not necessarily reflect the views of EXANTE. Any action taken upon the information contained in this publication is strictly at your own risk. EXANTE will not be liable for any loss or damage in connection with this publication.

This article is provided to you for informational purposes only and should not be regarded as an offer or solicitation of an offer to buy or sell any investments or related services that may be referenced here. Trading financial instruments involves significant risk of loss and may not be suitable for all investors. Past performance is not a reliable indicator of future performance.