Will inflation change the BoE’s outlook?

What to look out for today

Companies reporting on Wednesday, 22nd October: AT&T, Boston Scientific, CME Group, Thermo Fisher Scientific, Northern Trust, EQT, IBM, Tesla, Crown Castle, Teledyne Technologies, Hilton Worldwide Holdings, GE Vernova, Barclays, Hermes International

Key data to move markets today

UK: CPI and Core CPI, PPI Core Output, PPI, and Retail Price Index

EU: Speeches by ECB Vice President Luis de Guindos and ECB President Christine Lagarde

USA: Speeches by St. Louis Fed Governor Alberto Musalem and Fed Governor Michael Barr

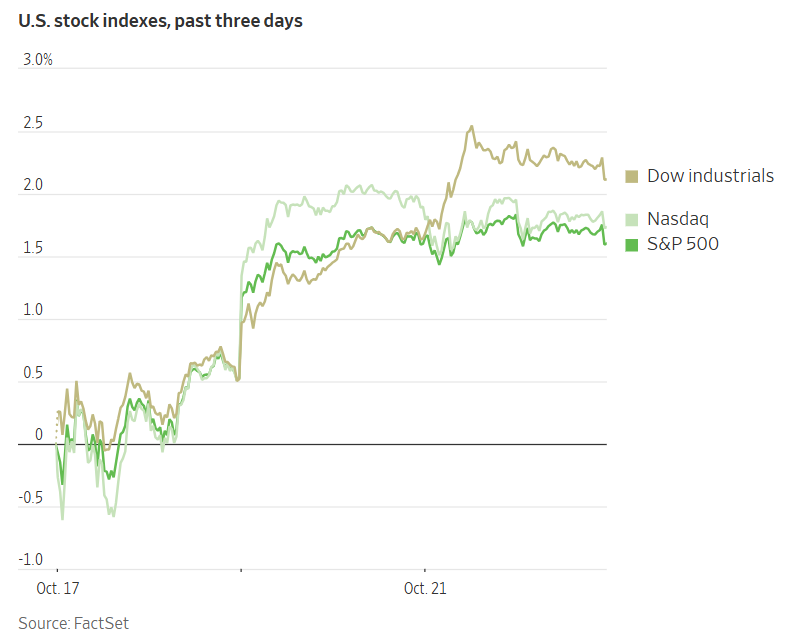

US Stock Indices

Dow Jones Industrial Average +0.47%

Nasdaq 100 -0.06%

S&P 500 +0.00 %, with 3 of the 11 sectors of the S&P 500 up

Robust earnings reports briefly propelled the Dow Jones Industrial Average above the 47,000 threshold for the first time, marking a significant milestone in the ongoing three-year bull market. Although the blue-chip index later retraced some of its gains and closed below this level, it still achieved a record high.

Given that sky-high earnings expectations are already priced, Wall Street has been closely monitoring Q3 results. Thus far, Corporate America has delivered. Coca-Cola, 3M, and General Motors all reported earnings exceeding analyst forecasts prior to Tuesday’s market opening.

On Tuesday, the S&P 500 ended the day unchanged, while the Nasdaq Composite declined by -0.16%. The Dow advanced by +0.47%, closing at a record 46,924.74.

In corporate news, Warner Bros. Discovery announced that it is considering the sale of some or all of its media assets, which include a movie studio, HBO Max, and CNN. Such a move has the potential to significantly reshape the entertainment landscape.

Activist investor Starboard Value has acquired an almost 5% stake in engineering and construction firm Fluor, according to The Wall Street Journal. According to sources familiar with the situation, Starboard believes that Fluor's core business is undervalued by the market in comparison to the value being assigned to its NuScale stake. The firm suggests that Fluor should explore options for the NuScale holding, such as a possible sale.

Shares of Six Flags Entertainment surged 18% after reports that activist investor Jana Partners, along with National Football League star Travis Kelce and other investors, have collectively acquired approximately 9% of the company’s shares, valued at $200 million. This group is advocating for changes at the theme-park operator.

Airbnb CEO Brian Chesky stated that the company has not integrated its online travel application with OpenAI's ChatGPT, citing that the platform’s connectivity tools are not yet fully developed.

Cargill reported an 86% y/o/y increase in Q3 profit, benefiting from favourable impacts of the One Big Beautiful Bill enacted earlier this year, and improved performance across all business segments, according to Bloomberg news.

Citigroup, Barclays, Bank of America, and RBC Capital Markets are among the financial institutions providing $12.25 billion in debt financing to facilitate Blackstone and TPG’s acquisition of medical device manufacturer Hologic, as reported by Bloomberg news.

Novo Nordisk announced that Chairman Helge Lund will step down following a boardroom dispute regarding the pace of organisational change. He will be succeeded by Lars Rebien Sorensen, the former chief executive of the Danish pharmaceutical company and current head of its largest shareholder.

S&P 500 Best performing sector

Consumer Discretionary +1.32%, with General Motors +14.83%, Lululemon Athletica +5.20%, and Ford Motor +4.75%

S&P 500 Worst performing sector

Utilities -0.99%, with Vistra -3.97%, Constellation Energy -3.03%, and NRG Energy -2.05%

Mega Caps

Alphabet -2.21%, Amazon +2.56%, Apple +0.20%, Meta Platforms +0.15%, Microsoft +0.17%, Nvidia -0.81%, and Tesla -1.08%

Information Technology

Best performer: Gartner +7.80%

Worst performer: Fair Isaac -3.37%

Materials and Mining

Best performer: Steel Dynamics +5.15%

Worst performer: Newmont -9.03%

European Stock Indices

CAC 40 +0.64%

DAX +0.29%

FTSE 100 +0.25%

As of 21st October, according to LSEG I/B/E/S data for the STOXX 600, Q3 2025 earnings are expected to increase 0.2% from Q3 2024. Excluding the Energy sector, earnings are expected to increase 0.3%. Q3 2025 revenue is expected to increase 0.2% from Q3 2024. Excluding the Energy sector, revenues are expected to increase 0.5%. 22 companies in the STOXX 600 have reported earnings for Q3 2025. 50.0% of these 22 companies reported results exceeding analyst estimates. In a typical quarter 54% beat analyst EPS estimates. 25 STOXX 600 companies have reported revenue to date for Q3 2025. Of these, 52.0% reported revenue exceeding analyst estimates. In a typical quarter 58% beat analyst revenue estimates.

The STOXX 600 expects to see shareweighted earnings of €123.3 bn in Q3 2025, compared to share-weighted earnings of €123.1 bn (based on the year-ago earnings of the current constituents) in Q3 2024.

Four of the ten sectors in the index expect improved earnings compared to Q3 2024. The Real Estate sector has the highest earnings growth rate at 4.9% for the quarter, while Utilities has the highest anticipated contraction of -6.1% compared to Q3 2024.

The forward four-quarter price-to-earnings ratio (P/E) for the STOXX 600 sits at 14.8x, above the 10-year average of 14.2x.

During the week of 27th October, 84 companies are expected to report quarterly earnings.

Analysts anticipate positive Q3 earnings growth in nine of the sixteen countries comprising the STOXX 600 index. Poland, with an estimated growth rate of 61.1%, and Ireland, at 27.2%, are projected to have the highest earnings growth, whereas Denmark and the Netherlands are expected to experience the most significant declines, estimated at -21.4% and -9.3%, respectively.

Corporate Earnings Reports

Posted on Tuesday, 21st October

General Motors quarterly revenue -0.3% to $48.591 bn vs. $45.037 bn estimate.

EPS at $2.80 vs. $2.29 estimate.

Mary Barra, Chair and CEO, said, “As we reflect on the third quarter of 2025, I want to begin by expressing my sincere appreciation for the dedication and hard work of the entire GM team, including our employees, dealers, and suppliers. Their unwavering focus on our customers and ability to navigate an evolving regulatory and policy environment has been truly outstanding. Thanks to the collective efforts of our team, and our compelling vehicle portfolio, GM delivered another very good quarter of earnings and free cash flow. In the U.S., we achieved our highest third-quarter market share since 2017 with strong margins, and our restructured China business was profitable once again. Based on our performance, we are raising our full-year guidance, underscoring our confidence in the company’s trajectory. ” — see report.

RTX quarterly revenue +11.9% to $22.478 bn vs. $21.303 bn estimate.

EPS at $1.70 vs. $1.41 estimate.

Chris Calio, Chairman and CEO, said, “Strong execution in the third quarter enabled us to deliver double-digit organic sales growth across all three segments and our sixth consecutive quarter of year-over-year adjusted segment margin expansion. We also received $37 billion of new awards in the quarter, reflecting robust global demand for our products and supporting long-term growth for RTX. Based on our year-to-date performance and ongoing demand strength, we are raising our full year outlook for adjusted sales* and EPS*. We remain focused on executing on our $251 billion backlog and increasing our output to support the ramp across critical programs, while investing in next-generation products and services that meet the needs of our customers.” — see report.

Netflix quarterly revenue +17.2% to $11.510 bn vs. $11.510 bn estimate.

EPS at $5.87 vs. $5.98 estimate.

The letter to shareholders stated, “Revenue in Q3 grew 17%, in-line with our forecast. Operating margin of 28% was below our guidance of 31.5% due to an expense related to an ongoing dispute with Brazilian tax authorities that was not in our forecast. Absent this expense, we would have exceeded our Q3'25 operating margin forecast. We don’t expect this matter to have a material impact on future results. Engagement remains healthy. We hit our highest quarterly view share ever in the US and UK, which has grown 15% and 22%, respectively since Q4’22, according to Nielsen and Barb.” — see report.

Commodities

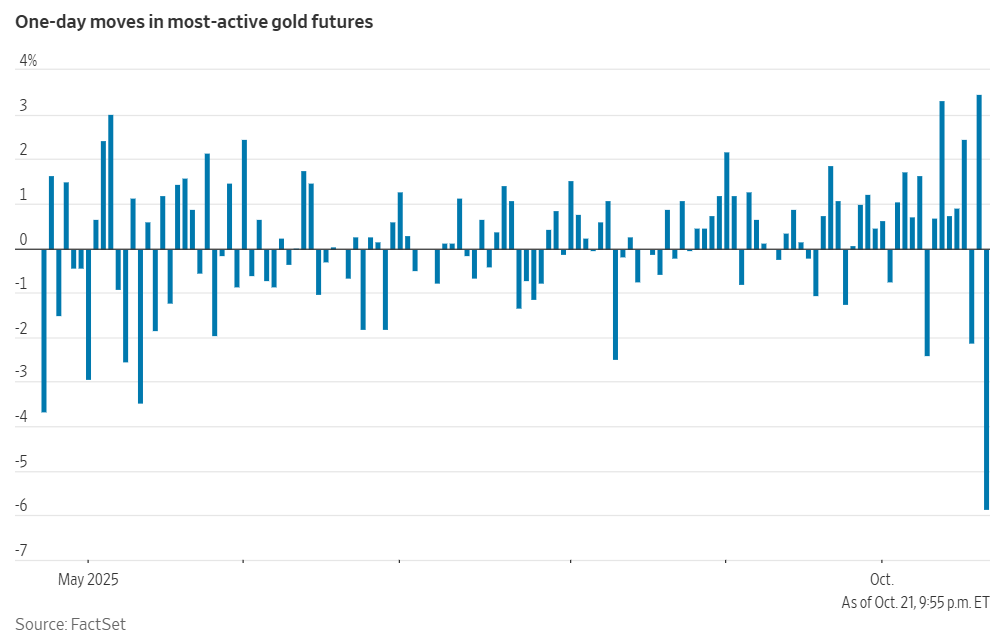

Gold spot -5.36% to $4,121.65 an ounce

Silver spot -7.11% to $48.74 an ounce

West Texas Intermediate +0.17% to $57.57 a barrel

Brent crude +1.17% to $61.61 a barrel

Gold prices experienced their sharpest single-day decline in five years on Tuesday, as investors opted to take profits following a surge to a record high in the previous session, which had been fuelled by expectations of lower US interest rates and continued safe-haven demand.

Spot gold fell by -5.36% to reach a one-week low of $4,121.65 per ounce, marking the most significant drop since August 2020. On Monday, prices had climbed to an all-time high of $4,381.21.

The dollar index increased by +0.37%, rendering bullion more expensive for investors holding other currencies.

Oil prices recorded modest gains on Tuesday, rebounding from the previous session’s five-month lows as investors reconsidered the likelihood of an impending supply surplus and awaited further developments regarding the ongoing trade dispute between the US and China, the world’s two largest oil consumers.

Brent crude futures increased by 71 cents, or +1.71%, settling at $61.61 per barrel. Meanwhile, US WTI crude futures for November delivery, which expired at Tuesday’s settlement, rose by 10 cents, or +0.17%, to close at $57.57 per barrel.

Both benchmarks had fallen to their lowest levels since early May on Monday, driven primarily by record US oil production and OPEC+'s decision to proceed with planned supply increases, which heightened concerns over potential oversupply.

Additionally, the futures curves for both WTI and Brent have shifted toward contango—where prices for prompt delivery are lower than those for future delivery—typically signalling ample near-term supply and weakening demand. Market participants continue to assess the extent to which this contango may deepen.

Note: As of 5 pm EDT 21 October 2025

Currencies

EUR -0.35% to $1.1603

GBP -0.27% to $1.3368

Bitcoin +0.29% to $110,932.63

Ethereum -0.72% to $3,950.59

The Japanese yen weakened to a one-week low on Tuesday following the election of Sanae Takaichi as Japan’s prime minister. Market participants interpreted her appointment as likely to introduce greater uncertainty to the interest rate outlook and potentially increase fiscal spending. Takaichi, who becomes Japan’s first female prime minister and leads the ruling Liberal Democratic Party, secured the position after winning the lower house vote, an outcome largely anticipated by investors due to her endorsement by the right-wing Ishin opposition party.

The yen depreciated by -0.84% to ¥151.87 per US dollar, having earlier reached its lowest level against the dollar since 14th October, marking its most significant single-day decline in two weeks. Earlier in the day, local media reported that Takaichi had finalised plans to appoint Satsuki Katayama, a former regional revitalisation minister, as finance minister.

Investor sentiment was influenced by Takaichi’s advocacy for fiscal stimulus and a more accommodative monetary stance, which complicates the BoJ’s path for monetary tightening. Politically, delaying monetary tightening may be considered until fiscal measures are effectively implemented, leaving the BoJ in a challenging position.

Across major currencies, trading was largely range bound. The US dollar index rose to a six-day high, supported by the weaker yen, increasing +0.37% to 98.96. The euro declined -0.35% against the strengthening dollar to $1.1603, while the British pound fell -0.27% to $1.3368, even as data indicated that UK government borrowing in the first half of the financial year reached its highest level since the pandemic.

Fixed Income

US 10-year Treasury -0.9 basis points to 3.974%

German 10-year bund -2.1 basis points to 2.559%

UK 10-year gilt -2.6 basis points to 4.488%

US Treasuries advanced for the second consecutive session on Tuesday, driving yields lower, as investors maintained their positioning for the possibility of multiple Fed rate cuts throughout the remainder of 2025 and into the following year.

With the FOMC meeting scheduled for next week, Fed officials are currently observing a blackout period during which public commentary on monetary policy is restricted.

Market participants are now awaiting Friday’s release of the CPI report for September, seeking further insight into whether inflation remains contained. The consensus among economists anticipates that core CPI, which excludes the more volatile food and energy categories, will rise by 0.3% m/o/m—matching the increase reported for August.

The publication of the CPI and several other key economic indicators has been delayed due to a three-week US government shutdown.

In afternoon trading, the yield on the 10-year Treasury note declined by -0.9 bps to 3.974%, while the 30-year bond yield decreased by -1.8 bps to 4.548%. On the shorter end of the curve, two-year Treasury yields, closely tied to interest rate expectations, edged down by -0.5 bps to 3.461%.

The US yield curve continued to exhibit bull flattening, with the spread between two-year and 10-year yields narrowing to 51.3 bps from 51.7 bps recorded on Monday.

According to CME Group's FedWatch Tool, Fed funds futures traders are pricing in a 98.9% probability of a 25 bps rate cut at October’s FOMC meeting, higher than last week’s 97.3%. Traders are currently expecting 49.8 bps of cuts by year-end, higher than the 48.6 bps anticipated the prior week.

Across the Atlantic, eurozone government bond yields declined on Tuesday, mirroring movements in US Treasuries. Germany’s 10-year Bund yield decreased by -2.1 basis points to 2.559%. This marks the fourth consecutive weekly drop for the Bund yield, as investors shifted toward safe-haven assets.

Within the eurozone, inflation remains near target and economic growth displays a degree of resilience. ECB President Christine Lagarde has consistently indicated that the ECB is in ‘a good place’, suggesting there is no immediate need for policy adjustments in upcoming meetings.

Futures markets currently reflect expectations that the ECB will maintain its policy rates through the end of the year, while also indicating an 80% probability of an additional quarter-point rate cut by 2026.

Germany's two-year yield, particularly sensitive to changes in interest rate expectations, edged -0.5 bps lower to 1.913%.

On Friday, Standard & Poor’s unexpectedly downgraded France’s sovereign rating to ‘A+/A-1’ from ‘AA-/A-1+’, citing political instability as a significant risk to the government’s efforts to restore fiscal health.

However, France’s 10-year yield fell -2.5 bps to 3.346%, maintaining the spread over Germany’s 10-year Bund at 78.7 bps. Meanwhile, Italy’s 10-year yield declined by -4.2 bps to 3.318%, keeping its spread over German Bunds narrower than France’s at 75.9 bps.

Note: As of 5 pm EDT 21 October 2025

Global Macro Updates

BoE’s Bailey and Breeden flag potential structural weakness in private credit. BoE Governor Andrew Bailey, in remarks reported by the Financial Times, drew a comparison between current risky lending practices in the private credit market and those that preceded the 2008 financial crisis. Testifying before the House of Lords’ financial services regulation committee on Tuesday alongside Deputy Governor Sarah Breeden, Bailey warned of parallels with the collapses of First Brands and Tricolor, as well as the onset of the subprime crisis. He emphasised that it remains an open question whether these developments signal a deeper, systemic issue within the market.

The warning from the IMF last week highlighted that the $4.5 trillion exposure of US and European banks to non-bank financial institutions, such as hedge funds and private credit groups, could intensify a downturn. According to the IMF, this exposure poses a risk of transmitting stress across the broader financial system, a concern that Bailey's subsequent comments echo.

Both Bailey and Breeden expressed concern regarding elevated leverage, weak underwriting standards, and insufficient transparency in private credit. Breeden confirmed an earlier Bloomberg news report, stating that the BoE is planning a comprehensive, system-wide exploratory scenario analysis of the broader private credit market. This initiative will utilise a framework similar to last year's review of risks to core UK financial markets, with further details to be provided later this year. She noted that the exercise is expected to take place within the next nine to twelve months.

Breeden told the same Lords committee hearing: “We can see the vulnerabilities here, the opacity, the leverage, the weak underwriting standards, the interconnections. We can see parallels with the global financial crisis. What we don’t know is how macro-significant those issues are.”

Research from the BoE has identified private credit as a significant source of funding for certain corporations; however, it has also highlighted risks stemming from the business models of some market participants and structural vulnerabilities in the industry. These risks include maturity and liquidity mismatches, as well as collective behaviour among firms, which may further exacerbate market instability.

No progress yet on ending the 21-day US government shutdown. The US federal government has now been closed for three full weeks, with no indication of significant progress toward reopening. On Monday, the Senate introduced the GOP stopgap bill for the eleventh time; once again, it failed to secure sufficient Democratic support, as reported by The Hill. The proposed continuing resolution would fund government operations through 21st November, but Republicans are reportedly considering alternative measures that could extend funding deadlines, potentially into 2026, according to Politico.

In addition, Republican lawmakers are discussing how to address the possible expiration of ACA insurance subsidies at the end of this year, which is a major concern for Democrats. Nonetheless, the GOP remains steadfast in its position that action will only be taken once the shutdown has been resolved. Meanwhile, there is ongoing speculation that pressure is mounting for a resolution. The economic ramifications are receiving increased attention, with the New York Times reporting that SNAP benefits are expected to lapse beginning 1st November.

Democratic leaders continue to oppose GOP-sponsored bills to pay troops and select federal workers during the shutdown, according to Axios. It is also noteworthy that, as of yesterday, White House economic advisor Hassett expressed optimism that there is a possibility the shutdown could come to an end this week.

While every effort has been made to verify the accuracy of this information, EXT Ltd. (hereafter known as “EXANTE”) cannot accept any responsibility or liability for reliance by any person on this publication or any of the information, opinions, or conclusions contained in this publication. The findings and views expressed in this publication do not necessarily reflect the views of EXANTE. Any action taken upon the information contained in this publication is strictly at your own risk. EXANTE will not be liable for any loss or damage in connection with this publication.

This article is provided to you for informational purposes only and should not be regarded as an offer or solicitation of an offer to buy or sell any investments or related services that may be referenced here. Trading financial instruments involves significant risk of loss and may not be suitable for all investors. Past performance is not a reliable indicator of future performance.