Will energy be the defining theme of 2026?

Key data to move markets today

EU: Eurogroup Meeting, German Harmonised Index of Consumer Prices and Italian CPI

USA: Industrial Production and a speech by Fed Vice Chair Michelle Bowman. US Stock and Bond markets are closed today for Martin Luther King, Jr day

US Stock Indices

Dow Jones Industrial Average -0.17%

Nasdaq 100 -0.07%

S&P 500 -0.06%, with 5 of the 11 sectors of the S&P 500 down

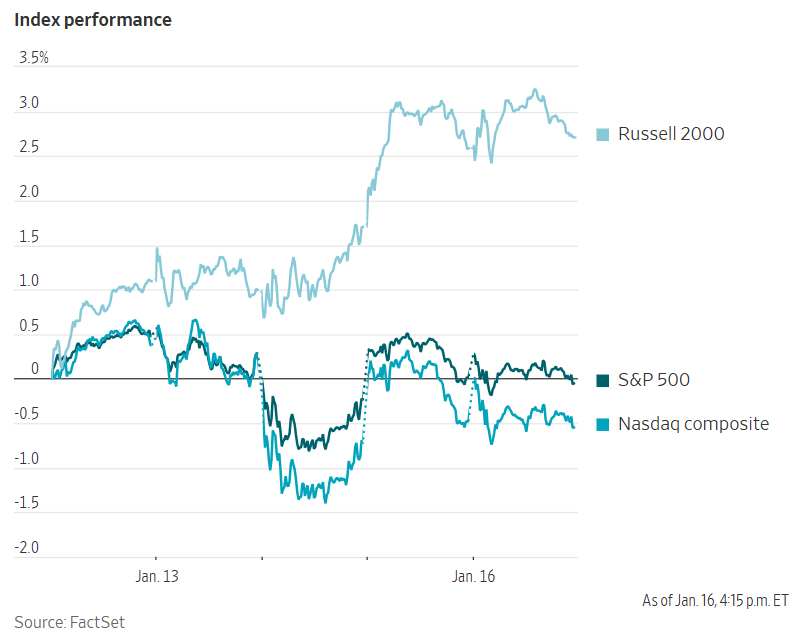

Equity markets were volatile on Friday, ultimately closing in negative territory. The Dow Jones Industrial Average was -0.17%, or 83.07 points, while both the S&P 500 and the Nasdaq Composite eased -0.06%.

The Russell 2000 index, which tracks small-cap companies, managed a modest gain of +0.12%, outperforming the S&P 500 for the eleventh consecutive session — a streak not seen since 2008, according to Dow Jones Market Data. Embarking on its most robust start to a year since 2021, the Russell 2000 has advanced +7.89% year-to-date, significantly outpacing the sub-two percent gains recorded by the S&P 500 and Nasdaq.

For the week, the S&P 500 was -0.38%, the Nasdaq Composite retreated -0.66%, and the Dow Jones Industrial Average fell -0.29%.

According to LSEG I/B/E/S data, y/o/y earnings growth for the S&P 500 in Q4 is projected to be +9.0%. This jumps to 9.4% when excluding the Energy sector. Of the 33 companies in the S&P 500 that have reported earnings to date for Q4 2025, 84.8% have reported earnings above analyst estimates, with 69.7% of companies reporting revenues exceeding analyst expectations. The y/o/y revenue growth is projected to be 7.3% in Q4, increasing to 8.1% when excluding the Energy sector.

Industrials and Information Technology, at 100.0%, are the sectors with most companies reporting above estimates. Information Technology with a surprise factor of 17.9%, is the sector that has beaten earnings expectations by the highest surprise factor. Within Consumer Discretionary, 60.0% of companies have reported below estimates and Financials is the sector with the lowest surprise factor at 5.6%. The S&P 500 surprise factor is 8.3%. The forward four-quarter price-to-earnings ratio (P/E) for the S&P 500 sits at 22.2x.

In corporate news, OpenAI has revealed plans to begin testing advertisements within the ChatGPT application for select users in the US. This represents a strategic shift as the company seeks to enhance revenue.

On the trade front, the US and Taiwan reached an agreement on Thursday to reduce tariffs on numerous Taiwanese semiconductor exports and to facilitate new investments in the American technology sector.

Paramount Skydance’s leadership has recently engaged in discussions with French President Emmanuel Macron as part of a European outreach initiative aimed at garnering support for its $108.4 billion unsolicited bid for Warner Bros. Discovery.

According to a report by Bloomberg news, the Federal Aviation Administration has issued an advisory to US airlines, recommending heightened vigilance when operating in the airspace over certain parts of Mexico and parts of Central and South America. The warning cites ongoing military activities and the potential for interference with navigation systems in these regions.

S&P 500 Best performing sector

Real Estate +1.20%, with Iron Mountain +3.52%, CoStar Group +3.09%, and Regency Centers +2.32%

S&P 500 Worst performing sector

Health Care -0.84%, with West Pharmaceutical Services -7.02%, Humana -3.76%, and Agilent Technologies -3.58%

Mega Caps

Alphabet -0.85%, Amazon +0.39%, Apple -1.04%, Meta Platforms -0.09%, Microsoft +0.70%, Nvidia -0.41%, and Tesla -0.24%

Information Technology

Best performer: Super Micro Computer +10.94%

Worst performer: Trimble -5.96%

Materials and Mining

Best performer: Martin Marietta Materials +1.67%

Worst performer: Amcor +7.29%

Corporate Earnings Reports

Posted on Friday, 16th January

State Street quarterly total revenue +7.5% to $3.667 bn vs $3.601 bn estimate

EPS at $2.97 vs $2.79 estimate

Ron O’Hanley, Chairman and CEO, said, “In the fourth quarter, we achieved record fee and total revenue, reflecting consistent year-over-year growth, with continued strong performance across Investment Services, Investment Management, and our Markets franchise. I am extremely proud of our teams who continued to deliver for our clients and shareholders in 2025. As we enter 2026, we will execute against our strategic priorities, including further embedding technology and artificial intelligence to drive further transformation across the franchise, continued growth of our core business, and expanding client solutions through innovation.” — see report.

M&T Bank quarterly total revenue +3.8% to $2.475 bn vs $2.472 bn estimate

EPS at $4.67 vs $4.48 estimate

Daryl N. Bible, CFO, said, “M&T finished 2025 with another quarter of strong financial performance. For the full-year 2025, M&T achieved a 16% increase in diluted earnings per common share, meaningfully reduced its level of criticized loans and improved its efficiency ratio while continuing to expand and improve our capabilities. M&T's fundamentals remain strong, positioning the Company for growth as we enter the new year. As we close out 2025, I'd like to thank my colleagues for their unwavering commitment to our customers and the communities we serve." — see report.

PNC Financial quarterly total revenue +9.1% to $6.071 bn vs $5.958 bn estimate

EPS at $4.88 vs $4.20 estimate

Bill Demchak, Chairman and CEO, said, “By virtually all measures, 2025 was a successful year. Strong execution across all business lines resulted in record revenue, well controlled expenses and 21% earnings per share growth. We're entering 2026 with great momentum and are excited about the opportunities in front of us, including the recently closed acquisition of FirstBank." — see report.

European Stock Indices

CAC 40 -0.65%

DAX -0.22%

FTSE 100 -0.04%

Commodities

Gold spot -0.44% to $4,594.94 an ounce

Silver spot -2.64% to $89.94 an ounce

West Texas Intermediate +0.03% to $59.30 a barrel

Brent crude +0.31% to $64.02 a barrel

Gold declined on Friday as investors took profits as geopolitical concerns around Iran declined amid fewer reported protests in Iran and a measured response from the US President. Spot gold fell -0.44% to close at $4,594.94 per ounce after reaching a session low of $4,536.49.

However, gold registered its second consecutive weekly advance, gaining +1.89% after achieving a record high of $4,642.72 on Wednesday.

Spot silver fell -2.64% to $89.94 per ounce, though it posted a weekly gain of +12.49% after reaching a historic high of $93.57 in the previous session.

Oil prices were slightly higher on Friday, as some investors moved to cover short positions.

Brent crude settled at $64.02 per barrel, an increase of $0.20, or +0.31%. US WTI ended the session at $59.30 per barrel, up $0.02, or +0.03%.

Both benchmarks reached multi-month highs last week as protests erupted in Iran and the US President indicated the possibility of military action. However, prices declined by more than two percent on Thursday after concerns regarding potential disruptions to oil supplies subsided.

For the week, WTI posted a gain of +0.88%, while Brent advanced +1.59%.

Note: As of 4 pm EST 16 January 2026

Currencies

EUR -0.08% to $1.1597

GBP +0.02% to $1.3381

Bitcoin -0.08% to $95,474.77

Ethereum -0.17% to $3,292.30

The US dollar edged higher on Friday, following remarks by President Donald Trump at a White House event in which he commended economic adviser Kevin Hassett and suggested the possibility of retaining him in his current position. This statement fuelled speculation that Hassett is less likely to be nominated as Chair of the Fed.

The US President is expected to announce his nominee to succeed Jerome Powell as Fed Chair in the coming weeks. Powell’s term as Fed chair is set to expire in May. The four leading candidates for the role are Kevin Hassett, Fed Governor Christopher Waller, former Fed Governor Kevin Warsh, and Rick Rieder, BlackRock’s chief bond investment manager.

On Friday, the dollar index rose +0.01% to 99.38. The index had reached a six-week high of 99.49 on Thursday. Over the course of the week, the dollar index advanced +0.24%, whereas the euro declined -0.34%.

The euro fell -0.08% to $1.1597 on Friday. The British pound experienced a modest increase on Friday, rising +0.02% to $1.3381, though it registered a weekly loss of -0.13%, marking its third consecutive week of declines.

The euro slipped -0.06% against the pound on Friday to 86.69 pence, extending its losing streak to five consecutive weeks against the British currency.

Investors continued to almost fully price in two quarter-point interest rate reductions by the BoE this year. However, the market does not expect a 25 bps cut until June and assigns only a 6% probability of a reduction at the central bank’s meeting next month.

The Japanese yen strengthened on Friday after Finance Minister Satsuki Katayama indicated that Japan would not rule out any measures to counter the currency’s weakness, including the possibility of coordinated intervention with the US Treasury.

Earlier in the week, the yen had fallen to an 18-month low against the dollar amid concerns that Prime Minister Sanae Takaichi would have increased flexibility to implement expansionary fiscal policies.

According to the party’s secretary general, Prime Minister Takaichi plans to dissolve parliament next week and call a snap election, seeking public endorsement for her fiscal initiatives.

The yen appreciated by +0.35% against the US dollar to ¥158.09 on Friday, though it declined by -0.13% versus the dollar over the week.

Reuters reported that some BoJ policymakers see the possibility of raising interest rates sooner than the market anticipates — potentially as early as April — due to the risk that a weakening yen could exacerbate inflationary pressures.

Fixed Income

US 10-year Treasury +4.9 basis points to 4.227%

German 10-year bund +1.8 basis points to 2.839%

UK 10-year gilt +0.5 basis points to 4.397%

US Treasury yields rose Friday, capping a weekly advance. Yields were volatile but range-bound last week as market participants reacted to the disclosure by Fed Chair Jerome Powell that the central bank had faced the threat of criminal indictment stemming from a building renovation project.

Additionally, several FOMC members voiced the necessity for prudence regarding future interest rate reductions.

The yield on the US 10-year Treasury note rose +4.9 bps on Friday to 4.227%, registering a weekly increase of +5.2 bps. The yield on the 30-year Treasury bond climbed +3.8 bps to 4.838%, up +1.9 bps for the week following a decline in the previous week.

The two-year US Treasury yield was +1.7 bps to 3.592% after reaching a five-week high of 3.613% earlier in the session. This marked a second consecutive weekly rise, advancing +5.6 bps last week.

The spread between the two- and 10-year Treasury note yields stood at 63.5 bps, narrowing by 0.4 bps from the prior week.

According to CME Group's FedWatch Tool, Fed funds futures traders are pricing in 46.3 bps of cuts in 2026, lower than the 51.1 bps priced in the previous week. Fed funds futures traders are now pricing in a 5.0% probability of a 25 bps rate cut at January’s FOMC meeting, up from 4.4% a week ago.

The German Bund yield curve ended the week modestly flatter, as yields on short-term Schatz securities increased while yields at the long end decreased.

Germany’s 10-year government bond yield rose +1.8 bps to 2.839%, though it recorded a weekly decline of -2.8 bps. This follows a decrease of -3.7 bps in the previous week, the most significant decline since late March.

The yield spread between US Treasuries and German Bunds widened to 138.8 bps, up from the prior week’s 130.8 bps. This spread reached a low of 122.9 basis points in mid-December, the narrowest since June 2023.

The German two-year yield increased +1.9 bps to 2.122%, culminating in a weekly rise of +0.6 bps. At the long end, the 30-year yield advanced +2.2 bps on the day to 3.425%, but posted a decrease of -4.8 bps over the week.

Italy’s 10-year government bond yield rose +2.0 bps to 3.462%, but ended the week -4.3 bps lower. The yield spread between the Italian 10-year bond and 10-year Bund narrowed to 62.3 bps, from the previous week’s 63.8 bps.

In France, the 10-year OAT yield increased +3.0 bps on the day but ended the week -0.9 bps lower at 3.521%. The spread against its German Bund counterpart widened by 1.9 bps over the week to 68.2 bps, compared to 66.3 bps the week before.

Note: As of 5 pm EST 16 January 2026

Global Macro Updates

EU gas prices rise defies bearish consensus on 2027 oversupply. European natural gas markets are currently characterised by a notable dichotomy between short-term supply constraints and the expectation of future oversupply. On Friday, TTF prices surged by 11.22% to approximately €36.89 per megawatt hour. This is the highest level since late July. It also registered the largest weekly increase in over two years at 29.97%. This escalation was driven by colder weather forecasts, below-average storage levels (52.5% compared to 65.0% at this time last year), reduced US LNG exports due to facility outages, and intensifying competition from Asian buyers amid their own cold snap, according to Bloomberg news. Although prices remain well below the peaks observed during the 2022 energy crisis, the recent sharp rally highlights the ongoing vulnerability of Europe’s gas market to prolonged demand shocks and volatility. The rapid price increase has also begun to impact bond markets, as investors express concerns about potential inflationary pressures. Additionally, speculative traders who had anticipated a weaker market were compelled to purchase futures to cover their positions, thereby further accelerating the rally.

While Europe has succeeded in attracting substantial seaborne gas supplies this winter and Norwegian pipeline flows have remained relatively stable, a significant decline in temperatures has recently increased demand for natural gas. Meteorological forecasts predict a Siberian cold front will affect much of Europe over the coming two weeks, necessitating firm price support for the region to remain competitive for LNG cargoes against other global buyers. Moreover, geopolitical uncertainties and speculative trading activity are amplifying market volatility. The combination of severe winter conditions in both Europe and Asia, low inventory levels, and renewed geopolitical tensions involving Iran has contributed to heightened risk premiums in the market.

Nevertheless, the current rally stands in contrast with the prevailing bearish outlook among analysts. In a note, UBS projected average prices of €29 per megawatt hour for 2026, anticipating the addition of 49 billion cubic metres of new LNG supply. Citi, in an even more cautious forecast, expects prices to reach €26 per megawatt hour in 2026 and €20 per megawatt hour in 2027, citing the onset of a global LNG oversupply beginning in 2027, driven by robust US production from the Haynesville shale and new Permian pipeline capacity. These views are consistent with the forecasts issued by analysts in December, with both Enverus and Wood Mackenzie maintaining a unanimously bearish stance.

A renewed tariff war? The EU is considering hitting the US with €93 bn worth of tariffs in response to President Trump’s threat to hit France, Germany, the UK, the Netherlands, Denmark, Norway, Sweden and Finland with 10% tariffs on 1 February which would rise to 25 per cent in June if the EU does not allow the US to purchase Greenland. EU leaders are expected to hold an emergency meeting in Brussels later this week to explore possible retaliatory measures. The most immediate and tangible reaction from the EU was that it will halt its July trade deal with the US, which still requires an endorsement from the European Parliament. As noted by the Financial Times, several EU officials are suggesting that President Trump has crossed a red line. However, the EU remains very dependent on its relationship with the US in terms of NATO and US supplies and intelligence and may not wish to risk breaking the transatlantic relationship. Germany, Sweden and Denmark are the most economically exposed, according to Bloomberg estimates. Given the level of weak industrial growth in Germany, which is becoming increasingly dependent on fiscal expenditures for future growth, along with its rising welfare bill, some behind the door discussions in Davos, Switzerland during this week’s World Economic Forum may be expected.

While every effort has been made to verify the accuracy of this information, EXT Ltd. (hereafter known as “EXANTE”) cannot accept any responsibility or liability for reliance by any person on this publication or any of the information, opinions, or conclusions contained in this publication. The findings and views expressed in this publication do not necessarily reflect the views of EXANTE. Any action taken upon the information contained in this publication is strictly at your own risk. EXANTE will not be liable for any loss or damage in connection with this publication.

This article is provided to you for informational purposes only and should not be regarded as an offer or solicitation of an offer to buy or sell any investments or related services that may be referenced here. Trading financial instruments involves significant risk of loss and may not be suitable for all investors. Past performance is not a reliable indicator of future performance.