Will US growth surprise to the upside?

What to look out for today

Companies reporting on Wednesday, 4th February: AbbVie, Alphabet, Boston Scientific, CME Group, Eli Lilly & Co, Fox, Phillips 66, Qualcomm, Uber Technologies, and Yum! Brands

Key data to move markets today

EU: Spanish, Italian, French, German, and Eurozone HCOB Composite and Services PMIs, Eurozone’s Harmonized Index of Consumer Prices and Core Harmonized Index of Consumer Prices, and Eurozone’s PPI

USA: ADP Employment Change, S&P Global Composite and Services PMIs, ISM Services PMI, Prices Paid, Employment and New Orders Indices, and a speech by Fed Governor Lisa Cook

US Stock Indices

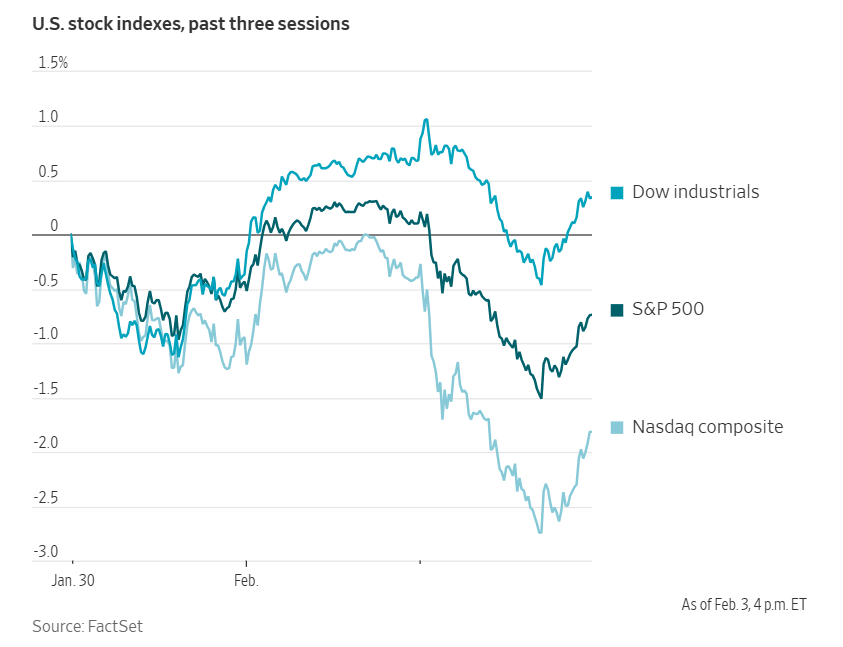

Dow Jones Industrial Average -0.34%

Nasdaq 100 -1.55%

S&P 500 -0.84%, with 6 of the 11 sectors of the S&P 500 down

Investor apprehension regarding the prospect of recent advancements in AI superseding traditional software sent shockwaves through the equity markets on Tuesday, resulting in declines for companies engaged in the development, licensing, and investment of software and systems.

On Tuesday morning, market attention was drawn to Anthropic’s announcement of the introduction of new legal tools within its Cowork assistant, aimed at automating a variety of legal drafting and research processes. This development prompted significant share price declines in firms such as Thomson Reuters, Legalzoom, and London Stock Exchange Group —all of which offer legal technology or research platforms—with each experiencing losses exceeding 12%.

As the trading session progressed, this downward trend extended across the broader software sector. Among the most adversely affected were PayPal, Expedia Group, EPAM Systems, Equifax, and Intuit, each recording declines of over 10%. Collectively, two S&P indices tracking software, financial data, and exchange-related equities saw their market capitalisations shrink by approximately $300 billion.

The Nasdaq Composite Index closed down by -1.43%, while the S&P 500 registered a decline of -0.84%. The Dow Jones Industrial Average, which has less exposure to the software sector, retreated by roughly 167 points, or -0.34%. However, the sell-off was not pervasive, as five of the S&P 500’s eleven sectors concluded the day in positive territory.

In corporate news, Netflix and Warner Bros. Discovery appeared before a discerning Senate panel on Tuesday, where their executives defended the proposed $82.7 billion media merger amid legislative concerns regarding its potential implications for streaming audiences and employees within the Hollywood sector.

Walt Disney has announced the appointment of Josh D’Amaro as the successor to Bob Iger in the role of chief executive officer, marking a pivotal transition for the entertainment conglomerate following previous challenges in leadership succession planning.

David Ellison, CEO of Paramount Skydance, declined an invitation to provide testimony before the Senate at an antitrust hearing concerning the proposed merger between Netflix and Warner Bros. Discovery.

Banco Santander has entered into an agreement to acquire Webster Financial for $12 billion, reflecting Spain’s largest bank’s strategic commitment to expanding its presence in the US market.

PepsiCo has announced price reductions of up to 15% on key brands such as Lay’s and Doritos, aiming to stimulate sales by offering more competitively priced products to consumers.

Pfizer disclosed preliminary data regarding one of its new obesity treatments early on Tuesday; however, the limited detail provided has left investors questioning whether the company’s investment—totalling up to $10 billion for the acquisition of the medicine’s developer—will yield the anticipated returns.

S&P 500 Best performing sector

Energy +3.29%, with Valero Energy +6.69%, Marathon Petroleum +6.03%, and Phillips 66 +4.11%

S&P 500 Worst performing sector

Information Technology -2.17%, with Gartner -20.87%, EPAM Systems -12.87%, and Intuit -10.89%

Mega Caps

Alphabet -1.22%, Amazon -1.79%, Apple -0.18%, Meta Platforms -2.08%, Microsoft -2.87%, Nvidia -2.84%, and Tesla +0.01%

Information Technology

Best performer: Teradyne +13.41%

Worst performer: Gartner -20.87%

Materials and Mining

Best performer: Ball +8.96%

Worst performer: Smurfit Westrock -2.53%

Corporate Earnings Reports

Posted on Tuesday, 3rd February

Advanced Micro Devices quarterly revenue +34.1% to $10.270 bn vs $10.270 bn estimate

EPS at $1.53 vs $1.53 estimate

Lisa Su, Chair and CEO, said, “2025 was a defining year for AMD, with record revenue and earnings driven by strong execution and broad-based demand for our high-performance and AI platforms. We are entering 2026 with strong momentum across our business, led by accelerating adoption of our high-performance EPYC and Ryzen CPUs and the rapid scaling of our data center AI franchise.” — see report.

Marathon Petroleum quarterly revenue -0.1% to $33.422 bn vs $31.084 bn estimate

EPS at $4.07 vs $2.72 estimate

Maryann Mannen, Chairman, President and CEO, said, "In 2025, strong refining operational performance and commercial execution drove cash flow generation. The deployment of MPC capital enhances our competitiveness in each of the regions where we operate. In Midstream, MPLX is investing to execute its natural gas and NGL growth strategies. Growing MPLX distributions differentiates MPC from peers and supports our commitment to industry-leading capital return." — see report.

Mondelez quarterly revenue +9.3% to $10.492 bn vs $10.496 bn estimate

EPS at $0.68 vs $0.72 estimate

Dirk Van de Put, Chair and CEO, said, “We delivered solid top-line results, generated strong cash flow, and returned significant cash to shareholders in a dynamic and challenging 2025 environment. While unprecedented cocoa cost headwinds impacted our profitability, our teams remained focused on what they can control to best position us for sustainable, profitable growth. As 2026 commences, we are executing clear plans to create multi-year shareholder value through improved volumes, brand investments, structural cost savings and disciplined capital allocation coupled with stabilizing cocoa costs. We remain convinced that our scale across markets—along with our stable of iconic brands, extensive route-to-market capabilities and supply chain strength—give us fundamental advantages in the years to come.” — see report.

European Stock Indices

CAC 40 -0.02%

DAX -0.07%

FTSE 100 -0.26%

Commodities

Gold spot +6.33% to $4,954.16 an ounce

Silver spot +7.42% to $85.09 an ounce

West Texas Intermediate +2.52% to $63.90 a barrel

Brent crude +2.27% to $67.99 a barrel

Gold and silver prices rebounded on Tuesday, following significant declines over the preceding two sessions. Bullion was poised for its most substantial daily increase since November 2008.

Spot gold advanced by +6.33% to reach $4,954.16 per ounce, rebounding from Monday’s intraday low of $4,403.24. Nevertheless, it remained below the previous week’s record high of $5,594.82.

Silver similarly rallied, surging +7.42% to $85.09 per ounce on Tuesday. This follows a record one-day decline on Friday and a further fall of -6.39% on Monday.

Oil prices advanced by over two percent on Tuesday following heightened geopolitical tensions, as the US downed an Iranian drone and armed vessels approached a US-flagged ship in the Strait of Hormuz. These developments have fuelled concerns that ongoing diplomatic efforts to de-escalate tensions between the US and Iran may be jeopardised.

Brent crude futures rose by $1.51, or +2.27%, to close at $67.99 per barrel, while US WTI crude increased by $1.57, or +2.52%, to settle at $63.90 per barrel.

On Monday, both key benchmarks had declined by more than five percent after the US President indicated that Tehran was ‘seriously talking’ with Washington.

However, on Tuesday, the US military intercepted and shot down an Iranian drone that reportedly approached the USS Abraham Lincoln aircraft carrier in the Arabian Sea in an ‘aggressive’ manner.

Additionally, maritime sources and a security consultancy reported that a flotilla of Iranian gunboats approached a US-flagged oil tanker north of Oman, in the strategic Strait of Hormuz between the Persian Gulf and the Gulf of Oman.

The Strait of Hormuz serves as a crucial passage for crude oil exports from OPEC members Saudi Arabia, Iran, the United Arab Emirates, Kuwait, and Iraq, with the majority of exports destined for Asian markets.

Iran is insisting that this week’s talks with the US be held in Oman rather than Turkey, and that discussions be strictly limited to nuclear issues. This stance has cast uncertainty over whether the meeting will proceed as scheduled.

In Ukraine, President Volodymyr Zelenskiy on Tuesday accused Russia of using a US-supported energy truce to amass munitions, subsequently employing them in attacks against Ukraine on the eve of planned peace negotiations.

The overnight assault disrupted heating in several cities, including Kyiv, as Ukrainian negotiators travelled to Abu Dhabi for a second round of US-brokered trilateral discussions scheduled for Wednesday and Thursday.

Any prolongation of the conflict in Ukraine is expected to keep oil prices elevated, as sanctions restricting Russian oil exports, imposed after Moscow’s 2022 invasion, would remain in force.

Note: As of 4 pm EST 3 February 2026

Currencies

EUR +0.25% to $1.1818

GBP +0.23% to $1.3697

Bitcoin -2.92% to $76,163.58

Ethereum -2.50% to $2,282.03

On Tuesday, the US dollar declined against most major currencies, with the exception of the yen.

The dollar index fell by -0.16% to 97.38. Meanwhile, the euro appreciated by +0.25% to reach $1.1818, and the pound strengthened by +0.23% to $1.3697.

Both the ECB and the BoE are expected to maintain their current policy rates at their respective meetings on Thursday. Market participants will closely monitor any indications from the ECB regarding whether the recent strength of the euro might influence future policy decisions.

Later in the week, attention will shift to Japan’s lower house election. In anticipation of the election scheduled for 8th February, investors reduced their holdings of yen and Japanese government bonds, speculating that a strong result for Prime Minister Sanae Takaichi's party could grant her greater scope to implement additional stimulus measures. The yen experienced some relief last week after Japanese policymakers signalled a willingness to coordinate with the US in efforts to support their currency.

The dollar increased by +0.09% against the yen to trade at ¥155.73, though it remained below the 18-month peak of ¥159.45 reached in mid-January.

Fixed Income

US 10-year Treasury -1.2 basis points to 4.267%

German 10-year bund +2.4 basis points to 2.894%

UK 10-year gilt +1.8 basis points to 4.527%

US Treasury yields edged lower on Tuesday, as market participants contended with delays in the release of key economic data resulting from a partial government shutdown.

The yield on the two-year Treasury note, sensitive to expectations regarding Fed policy, declined by -0.8 bps to 3.578%. The yield on the 10-year note decreased by -1.2 bps to 4.267%.

The spread between two-year and 10-year Treasury yields narrowed slightly, flattening by 0.4 bps to 68.9 bps, following Monday’s figure of 72.7 bps — the steepest curve since April.

The release of the government’s closely monitored employment report for January, originally scheduled for Friday, has been postponed as a consequence of the partial shutdown.

On Tuesday, the US House of Representatives narrowly passed a bipartisan agreement to end the partial government shutdown, forwarding the legislation to President Trump for approval.

According to CME Group's FedWatch Tool, Fed funds futures traders are pricing in 48.9 bps of cuts in 2026, lower than the 49.1 bps priced in the previous week. Fed funds futures traders are now pricing in a 8.9% probability of a 25 bps rate cut at the 18th March FOMC meeting, down from 16.7% a week ago.

On Tuesday, short-term government bond yields in the eurozone declined, while yields on longer-dated bonds edged higher.

Germany’s 10-year government bond yield increased by +2.4 bps to 2.894%. This level is approaching the 2.94% peak seen in March last year, when the German government announced significant plans for expanded fiscal expenditure.

German two-year bond yields recorded their sharpest monthly decline since April of the previous year, as investors anticipated that the ECB would take into account the deflationary effects of a stronger euro when shaping monetary policy. On Tuesday, the two-year yield fell by -3.5 bps to 2.099%.

In the money markets, participants priced in approximately a 20% likelihood of a rate cut by the ECB in September, alongside a 30% probability of an interest rate hike in April 2027.

French 10-year government bond yields climbed by +1.5 bps to 3.467%. The yield spread over safe-haven German Bunds stood at 57.3 bps, having narrowed to as low as 53.5 bps in mid-January, the tightest spread since August 2008.

Meanwhile, Italy’s 10-year government bond yield advanced by +1.0 bps to 3.495%, with the yield spread over Bunds at 60.1 bps.

Note: As of 5 pm EST 3 February 2026

Global Macro Updates

ISM Manufacturing Index reaches highest level since August 2022. In January, the ISM Manufacturing Index rose to 52.6, significantly surpassing both the consensus estimate of 48.9 and December’s reading of 47.9. This marks the highest level since August 2022.

New orders increased to 57.1 from 47.4 in December, indicating expansion for the first time since August. Employment improved to 48.1 from 44.8, while production climbed to 55.9 from 50.7, the highest level since February 2022. The prices index also edged higher to 59.0 from 58.5.

Despite the positive headline figures, feedback from survey respondents remained somewhat negative. Participants noted that demand continued to be subdued heading into 2026, with buyers deferring expenditure and order activity remaining soft. Tariffs were cited as the principal headwind, with additional concerns raised about geopolitical tensions and ongoing labour shortages.

Elsewhere, the final S&P Global PMI Manufacturing for January was recorded at 52.4, exceeding the consensus of 49.5 and the prior month’s 51.8. The growth was driven in part by inventory accumulation, as new orders increased only modestly.

The survey indicated a continued rise in staffing levels, though the pace of hiring was the slowest in three months. Input cost inflation accelerated, primarily due to tariffs, while manufacturers increased their own charges at the fastest rate since last August.

While every effort has been made to verify the accuracy of this information, EXT Ltd. (hereafter known as “EXANTE”) cannot accept any responsibility or liability for reliance by any person on this publication or any of the information, opinions, or conclusions contained in this publication. The findings and views expressed in this publication do not necessarily reflect the views of EXANTE. Any action taken upon the information contained in this publication is strictly at your own risk. EXANTE will not be liable for any loss or damage in connection with this publication.

This article is provided to you for informational purposes only and should not be regarded as an offer or solicitation of an offer to buy or sell any investments or related services that may be referenced here. Trading financial instruments involves significant risk of loss and may not be suitable for all investors. Past performance is not a reliable indicator of future performance.